Commercial Mortgage-Backed Securities (CMBS)

“Wow, that’s a lot of five dollar words”

Right…let’s unpack it.

Buckle up.

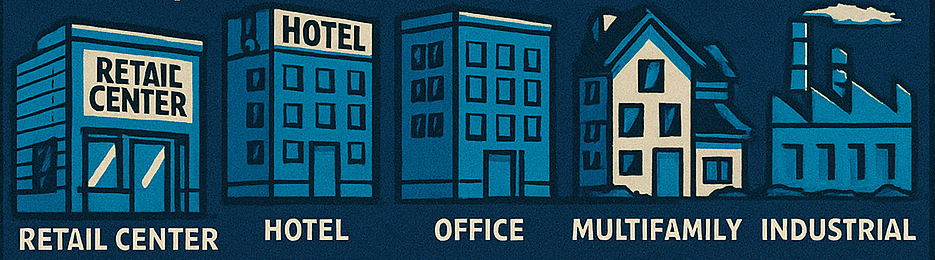

- Commercial Mortgage-Backed Securities (CMBS) are financial instruments created by bundling together a pool of commercial real estate loans and selling them as bonds to investors. These loans are secured by income-producing properties such as……

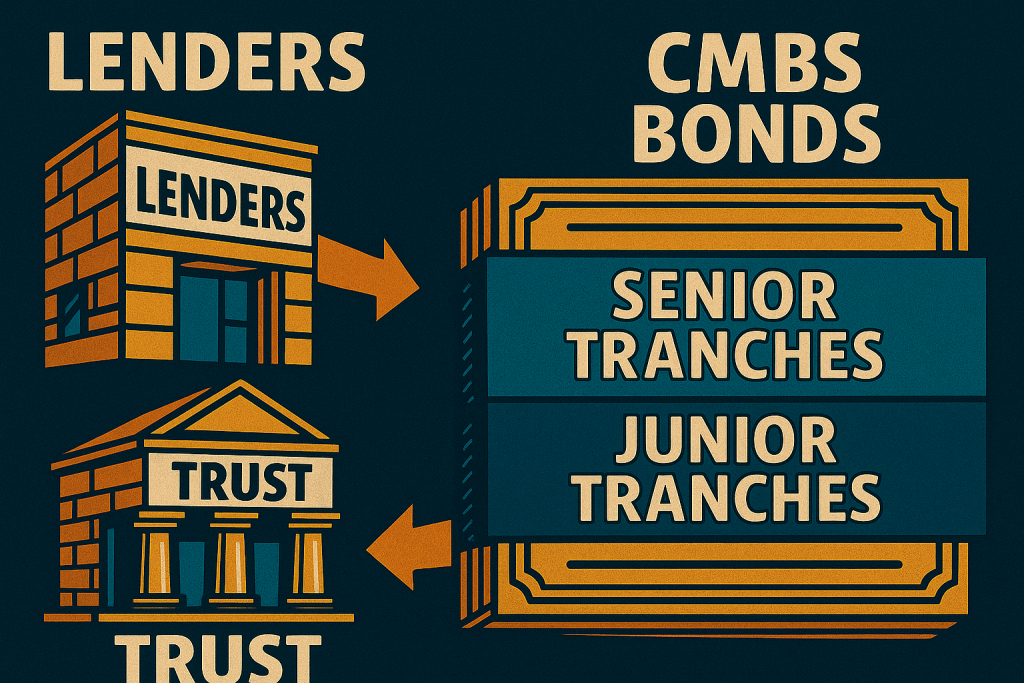

- Lenders originate commercial mortgages and sell them to a trust, which then packages the loans into a single investment vehicle. The trust issues CMBS bonds that are sold to investors in tranches, or layers, each with different levels of risk and return. Senior tranches receive priority on payments and carry lower risk, while junior tranches offer higher returns but bear more risk of loss.

Common Use Cases

CMBS are widely used in institutional real estate transactions and by borrowers seeking:

- Large loan amounts

- Non-bank financing

- Fixed-rate, long-term debt

They are most commonly found in stabilized, income-producing properties where loan performance can be more easily predicted.

Borrower Considerations

CMBS loans can be appealing to borrowers due to:

- Longer loan terms (often 5–10 years longer than conventional loans)

- Non-recourse structure, limiting borrower liability

However, they come with significant limitations:

- Strict prepayment restrictions such as:

- Defeasance: Replacing the property collateral with government securities

- Yield maintenance: Paying a fee that ensures the lender’s expected return

- Limited flexibility for refinancing or early payoff

- Standardized underwriting that may not allow for negotiation

Investor Benefits & Risks

Investor Benefits

- Diversification: CMBS spread risk across many properties and borrowers.

- Regular Income: Investors receive monthly or quarterly payments from interest and principal on the underlying loans.

- Attractive Yields: CMBS can offer higher returns than traditional government or corporate bonds, depending on the tranche.

Investor Risks

- Market sensitivity: CMBS performance is tied to real estate market health and interest rates.

- Credit risk: If borrowers default, junior tranches can experience significant losses.

- Liquidity risk: Some CMBS bonds, especially lower-rated tranches, may be hard to sell during market downturns.

Best Practices & Considerations for Borrowers Contemplating CMBS Loans

- Understand Loan Structure & Servicing

- CMBS loans are non-recourse: This protects personal assets but shifts focus to property performance.

- Loans are pooled and securitized, then serviced by a Master Servicer and potentially a Special Servicer—borrower requests (like refinancing or lease restructuring) may be slow or rigid.

- Know the Prepayment Restrictions

- CMBS loans usually prohibit simple payoff before maturity.

- Prepayment options typically include:

- Defeasance (replacing loan with U.S. Treasuries)

- Yield Maintenance (compensating lender for lost interest)

- Plan ahead if a future sale or refinance is likely.

- Evaluate Property Suitability

- Best suited for stabilized, income-producing properties (e.g., retail centers, office buildings, apartments).

- Lenders scrutinize tenant mix, lease terms, occupancy rates, and location.

- Prepare for Upfront and Ongoing Costs

- Third-party reports (e.g., appraisal, engineering, environmental)

- Legal and securitization fees

- Possible lockbox or cash management requirements

- Expect Limited Flexibility

- CMBS is not ideal for transitional assets or properties needing major repositioning.

- Modifying loan terms post-closing is difficult.

- Assess Exit Strategy Carefully

- Confirm if defeasance or yield maintenance fits your timeline.

- Factor in costs and process for exiting the loan early.

- Refinancing options may be limited near maturity without planning.

- Use Experienced Advisors

- Work with a mortgage broker or attorney experienced in CMBS.

- Have them review the Pooling & Servicing Agreement (PSA) and loan documents.

- They can help negotiate terms and avoid unfavorable surprises.

In Summary

CMBS loans offer long-term, fixed-rate, non-recourse financing and are excellent for stable properties with predictable cash flow. But borrowers must prepare for limited flexibility, strict prepayment rules, and complex servicing structures. Proper planning, expert guidance, and clear exit strategies are essential to make CMBS a strategic fit.