Collateral & Collateral Value in Commercial Lending

“Assets on Deck, Risk in Check.”

Collateral is an asset your business pledges to a lender as a form of security when you borrow money.

If your business can’t repay the loan, the lender has the legal right to seize and sell the collateral to recover their money.

Think of collateral as the lender’s “Plan B.”

Loan-to-Value (LTV) Ratio

♦ LTV…a critical concept in the realm of Collateral ♦

The LTV ratio tells lenders how much risk they are

taking based on the collateral you’re offering.

Formula:

LTV = (Loan Amount ÷ Collateral Value) × 100%

Example:

A business wants to borrow $1,000,000 to buy a building that’s been professionally appraised at $1,500,000.

LTV = ($1,000,000 ÷ $1,500,000) × 100 = 66.7%

This is within the acceptable range for comm’l

real estate loans (usually up to 75–80%).

Why It Matters:

- Lower LTV = Lower Risk to Lender

You may get better loan terms, lower interest rates, or quicker approval. - Higher LTV = Higher Risk to Lender

This may lead to higher rates, more conditions, or the need for a personal guarantee. - Too High an LTV = Loan Denied or Reduced

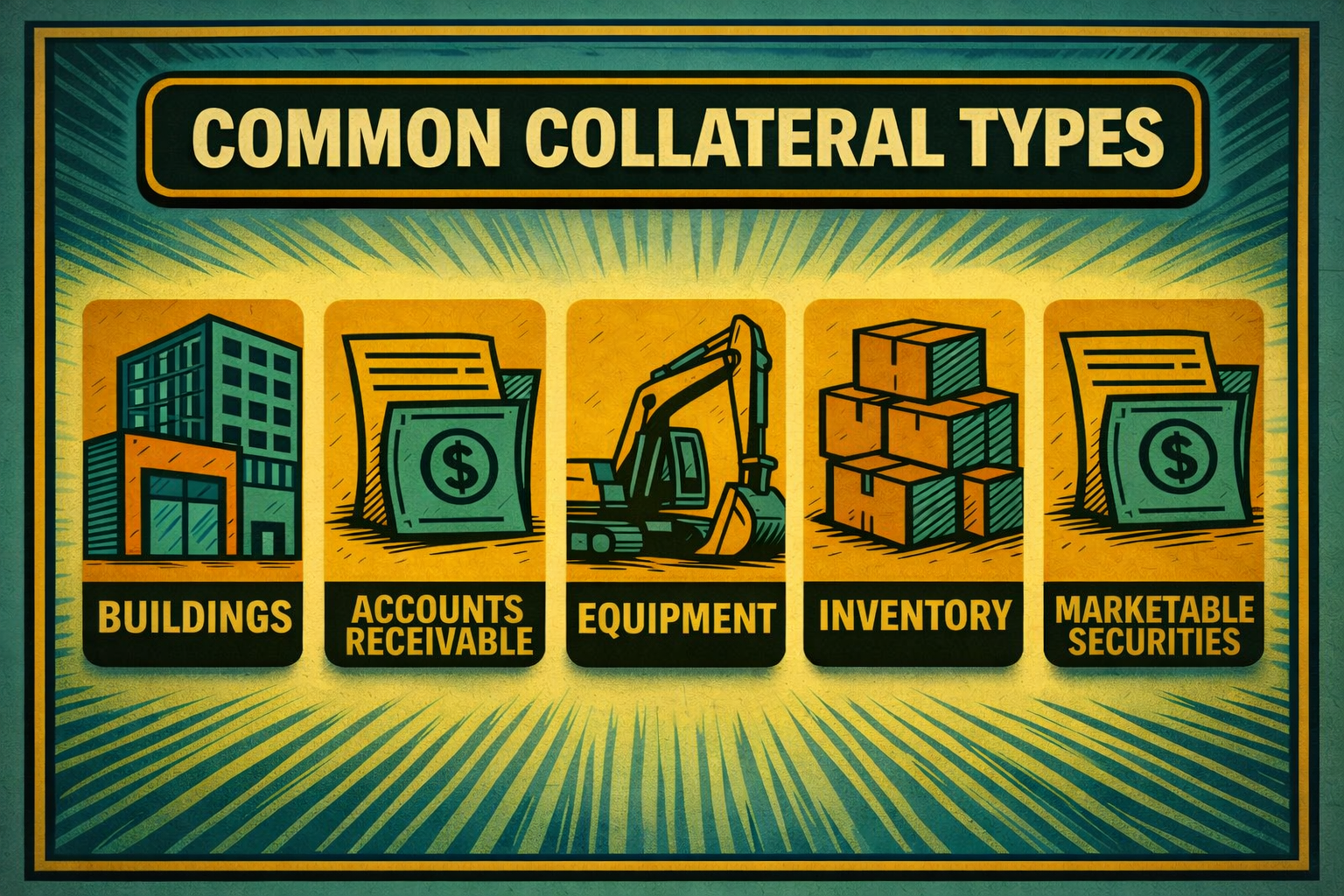

Advance Rates for Common Collateral

| Collateral Type | Advance Rate (LTV Cap) | Key Notes |

|---|---|---|

| Commercial Real Estate | 65%–80% | Based on the lower of appraised value or purchase price |

| Equipment | 50%–75% | Age, condition, and resale market influence the value |

| Accounts Receivable | 70%–90% | Only recent, collectible receivables (usually under 90 days) qualify |

| Inventory | 30%–60% | Risky due to obsolescence or valuation difficulties |

| Marketable Securities | 50%–95% | Liquid and easy to sell; may be subject to margin rules |

Why LTV is Crucial to Loan Approval

Lenders want to know:

If things go wrong, can we recover our money by selling the collateral?

What You Need to Know:

- Lenders prefer LTVs below the maximum cap for each collateral type.

- Collateral alone doesn’t guarantee approval — but it’s a major factor.

- If collateral is too weak or overvalued, you may be asked to:

- Provide additional assets

- Put in more cash (equity)

- Accept a smaller loan

Other Collateral Types:

Cash or Certificates of Deposit (CDs)

- Very low risk for lenders

- Often used in secured personal or business lines of credit

- Can sometimes result in lower interest rates

Personal or Commercial Vehicles

- Cars, trucks, fleet assets

- Value is discounted based on age, condition, and mileage

Owner-Occupied Real Estate

- Includes personal property or mixed-use buildings

- Sometimes pledged in smaller businesses as secondary collateral

Intellectual Property (IP)

- Patents, trademarks, copyrights, software code

- Difficult to value and liquidate; more common in venture lending or IP-backed lending

Franchise Agreements / Contracts

- Pledged future revenue streams from enforceable agreements

- Used in industries like healthcare, food service, or franchise operations

Machinery or Fixtures

- Specialized equipment permanently affixed to property

- Often valued less than mobile equipment due to removal/damage concerns

Livestock or Crops

- Common in agricultural finance

- Requires special expertise, regular monitoring, and insurance

Precious Metals or Commodities

- Gold, silver, oil, or other physical stores of value

- Require storage and validation

Inventory-in-Transit

- For import/export or logistics-based businesses

- Requires tight control and documentation

Business Ownership (Equity Pledge)

- Pledging shares of the company (or its subsidiaries)

- Common in mezzanine financing or with holding companies

Caveats:

- These assets often have lower advance rates or require third-party verification or insurance.

- Liquidity and valuation difficulty are the two biggest drawbacks.

- Lenders are less likely to accept collateral they cannot easily sell.

Other Collateral Considerations for Business Owners

✅ Appraised Value vs. Book Value

- Banks use third-party appraisals, not your internal accounting values.

✅ Marketability

- Lenders want assets that can be sold quickly and easily.

✅ Depreciation

- Equipment loses value over time — be realistic about resale value.

✅ Collateral Shortfall

- If your primary asset isn’t enough, be ready to pledge more assets or put in more equity.

✅ Blended Collateral

- If you use more than one type of asset (e.g., equipment + A/R), the lender will assess each category’s value and apply the respective advance rate. The final loan amount is based on the combined, discounted value.

💡 Bonus: Collateral Coverage Ratio

Formula: Collateral Coverage = Collateral Value ÷ Loan Amount

Collateral Coverage Ratio (CCR) and Loan-to-Value (LTV) are two sides of the same coin,

both expressing the relationship between a loan and the value of the collateral securing it.

A coverage ratio above 1.25 is often considered strong. For example, $1.5M collateral for a $1M loan = 1.5x coverage.

Practical Implication

– Lenders may set minimum CCRs or maximum LTVs in loan covenants.

– Business owners can use either measure to understand how much borrowing power their assets provide.