Triple Net Lease (NNN) Structures

“Pay the Rent — and the Rest”

Shifting Costs, Shaping Cash Flow

A Triple Net Lease (NNN) is a type of commercial lease where the tenant agrees to pay not only rent, but also property taxes, insurance, and maintenance (the “three nets”).

It’s widely used in retail, office, and industrial real estate, particularly with investment-grade properties and national tenants.

Base Rent: Paid to the landlord.

Net Expenses: Tenant covers:

Property Taxes

Insurance Premiums

Maintenance/Operating Costs (repairs, landscaping, upkeep, etc.).

This structure pushes operating risk and cost variability from the landlord to the tenant.

Business Impact

For Tenants (Business Owners):

Predictable rent but unpredictable occupancy costs.

Responsibility for keeping property in good condition.

NNN leases can be long-term, limiting flexibility if expenses rise.

For Landlords:

Stable, low-maintenance income stream.

Reduced exposure to property expense volatility.

Attractive to investors looking for predictable yields.

For Lenders:

NNN leases with strong tenants are highly financeable because they lower landlord risk.

However, tenant creditworthiness becomes critical.

Advantages for Business Owners

✅ Lower base rent compared to gross leases.

✅ Long-term control and ability to customize space.

✅ Potentially favorable financing terms if leasehold interest is pledged.

Risks for Business Owners

❌ Rising property taxes or insurance premiums can squeeze margins.

❌ Major repair obligations (e.g., roof, HVAC) fall on the tenant.

❌ Less exit flexibility if the lease is long-term and market conditions change.

A Triple Net Lease transfers most property risks and costs from landlord to tenant.

- For tenants, it means lower rent but higher responsibility.

- For landlords, it’s predictable, low-maintenance income.

Success depends on carefully projecting expenses and ensuring the lease aligns with long-term business strategy.

Strategic Use Cases

National Retail Chains (e.g., drugstores, fast food, gas stations): Lock in high-traffic sites with predictable rent.

Professional Services (medical, banks, offices): NNN gives long-term stability while tailoring space to brand needs.

Investors/Landlords: Use NNN properties as “bond-like” assets for steady income with minimal landlord duties.

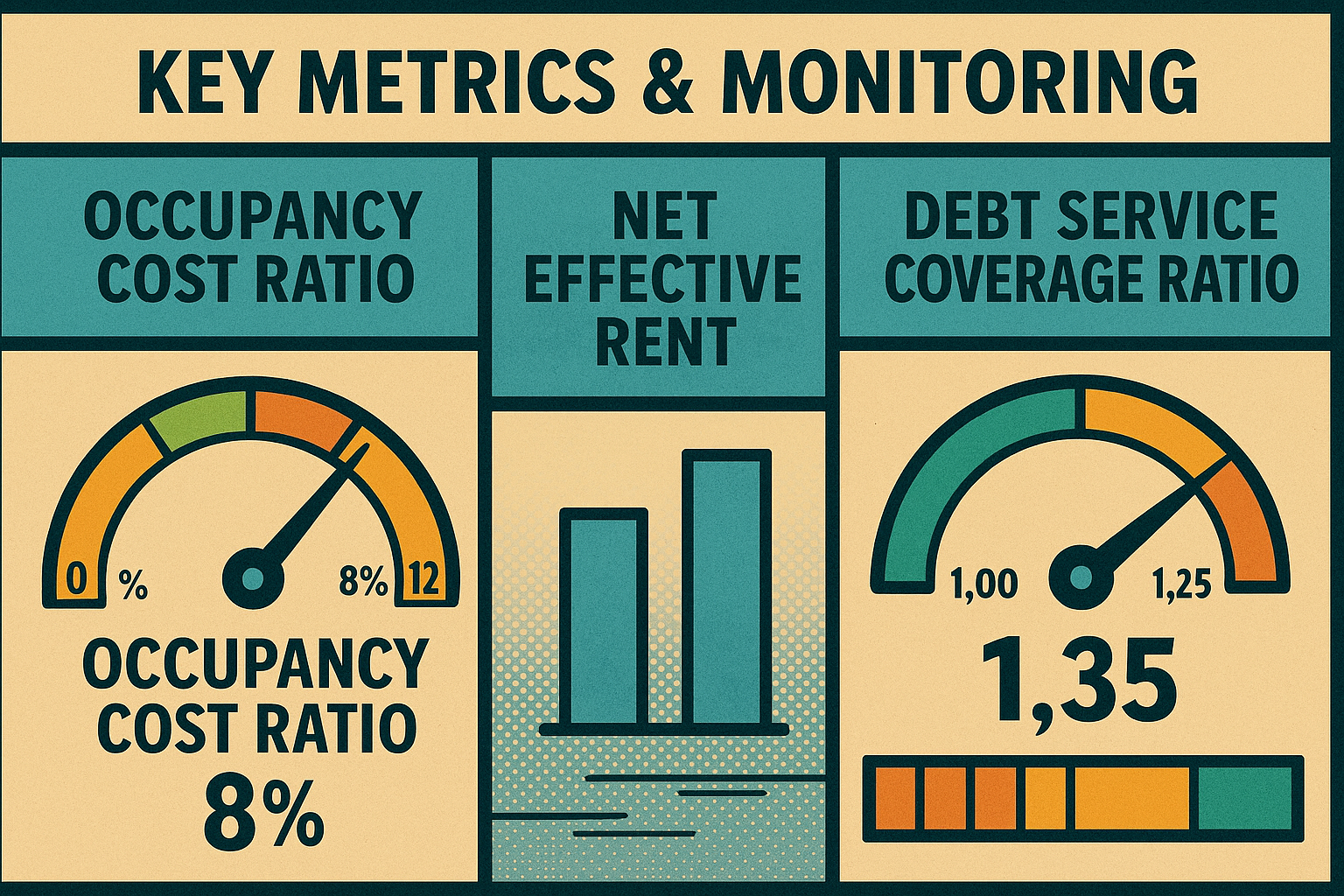

Key Metrics & Monitoring

Occupancy Cost Ratio: Total occupancy costs ÷ gross sales (critical for retail tenants).

Net Effective Rent: Base rent + average annual pass-through costs.

DSCR (Debt Service Coverage Ratio): For lenders, factoring in pass-through expenses to test tenant’s repayment capacity.

(expanded section below on these metrics)

Best Practices for Business Owners: Triple Net Lease (NNN)

Project Total Occupancy Costs — Not Just Base Rent

- Don’t stop at the advertised rent. Add property taxes, insurance, and maintenance into your cost model.

- Use a 5–10 year projection to account for rising taxes and insurance premiums.

- Track the Occupancy Cost Ratio (total occupancy costs ÷ gross sales) to ensure it stays healthy, especially for retail.

Scrutinize Maintenance Obligations

- NNN leases often push big-ticket items (roof, HVAC, parking lot) to the tenant.

- Have an engineer or contractor inspect the property before signing — to avoid inheriting deferred maintenance.

- Negotiate caps or landlord responsibilities for “structural” or “extraordinary” repairs.

Negotiate Expense Transparency

- Require annual statements from the landlord detailing tax, insurance, and common area maintenance charges (CAM).

- Ask for the right to audit or review pass-through costs.

- Push for limits on landlord markups or administrative fees tied to maintenance.

Match Lease Term to Business Strategy

- NNN leases are typically long-term (10–25 years) — great for stability but limiting for flexibility.

- Match lease length to your growth horizon:

- Mature brand/location: Long-term makes sense.

- Emerging or scaling business: Consider shorter terms or more renewal options.

Factor in Financing Implications

- Some lenders treat NNN leases as highly financeable if the tenant is strong — but if you’re the tenant, you’re effectively taking on landlord-like obligations.

- Ensure your Debt Service Coverage Ratio (DSCR) accounts for variable lease expenses.

- Plan for capital reserves so sudden repair obligations don’t disrupt cash flow.

Secure Exit Flexibility

- Negotiate assignment and subletting rights in case you need to sell your business or relocate.

- Push for buyout or early termination options if market conditions change.

- Consider whether the NNN lease adds or detracts from your business’s resale value.

Get Expert Guidance

- Legal: To clarify what “maintenance” really includes.

- Financial: To stress-test lease costs against revenue projections.

- Technical: To assess building condition and long-term cost risks.

✅ Takeaway:

For tenants, NNN leases trade lower base rent for higher responsibility. The winners are the businesses that model the full cost picture, negotiate protections, and align lease terms with strategy.

Key Metrics & Monitoring Triple Net Lease (NNN)

Monitoring an NNN lease goes beyond paying rent on time.

Because tenants take on taxes, insurance, and maintenance, performance must be measured with a total-cost lens.

Below are the core metrics to watch:

Occupancy Cost Ratio

- Definition: Total occupancy costs ÷ Gross Sales.

- Occupancy costs = base rent + property taxes + insurance + maintenance (CAM).

- Why It’s Important: This ratio shows whether your location is financially sustainable. If the percentage is too high, rent and pass-throughs are eating into profit.

- Benchmarks:

- Retail & restaurants: usually 8–12% of sales is considered healthy.

- If costs push past 15%, profitability is at risk.

- Owner’s Lens: Compare across locations (if multi-unit) to identify underperforming sites.

- Banker’s Lens: A low, stable ratio signals strong tenant performance and repayment ability.

Net Effective Rent

- Definition: Base Rent + Average Annual Pass-Through Costs (taxes, insurance, maintenance).

- Why It’s Important: NNN leases advertise “low base rent,” but actual costs are higher once pass-throughs are added. Net effective rent reflects the real financial burden.

- How to Monitor:

- Track annual increases in taxes and insurance.

- Calculate rolling 3–5 year averages to smooth out volatility.

- Owner’s Lens: Prevent surprises by budgeting total rent obligations, not just base rent.

- Banker’s Lens: Net effective rent clarifies the tenant’s actual cash outflow, aligning loan structuring with true occupancy cost.

Debt Service Coverage Ratio (DSCR)

- Definition: Net Operating Income (NOI) ÷ Total Debt Service.

- For NNN tenants, NOI must account for all pass-through costs (taxes, insurance, CAM).

- Why It’s Important: Lenders use DSCR to determine whether a business can cover both debt payments and NNN lease obligations.

- Benchmark:

- Most lenders require a DSCR of 1.25x or higher (i.e., $1.25 of NOI for every $1 of debt service).

- Owner’s Lens: Stress-test DSCR under different tax/insurance scenarios to avoid sudden coverage shortfalls.

- Banker’s Lens: A tenant with strong DSCR even after factoring pass-throughs is a safer bet for leasehold or business financing.

✅ Takeaway:

For NNN tenants, success means tracking not just rent, but the all-in occupancy burden. Monitoring Occupancy Cost Ratio, Net Effective Rent, and DSCR ensures you know whether the lease is helping your business thrive or quietly eroding margins.