Interest Rate Components

“What Builds the Rate You Pay”

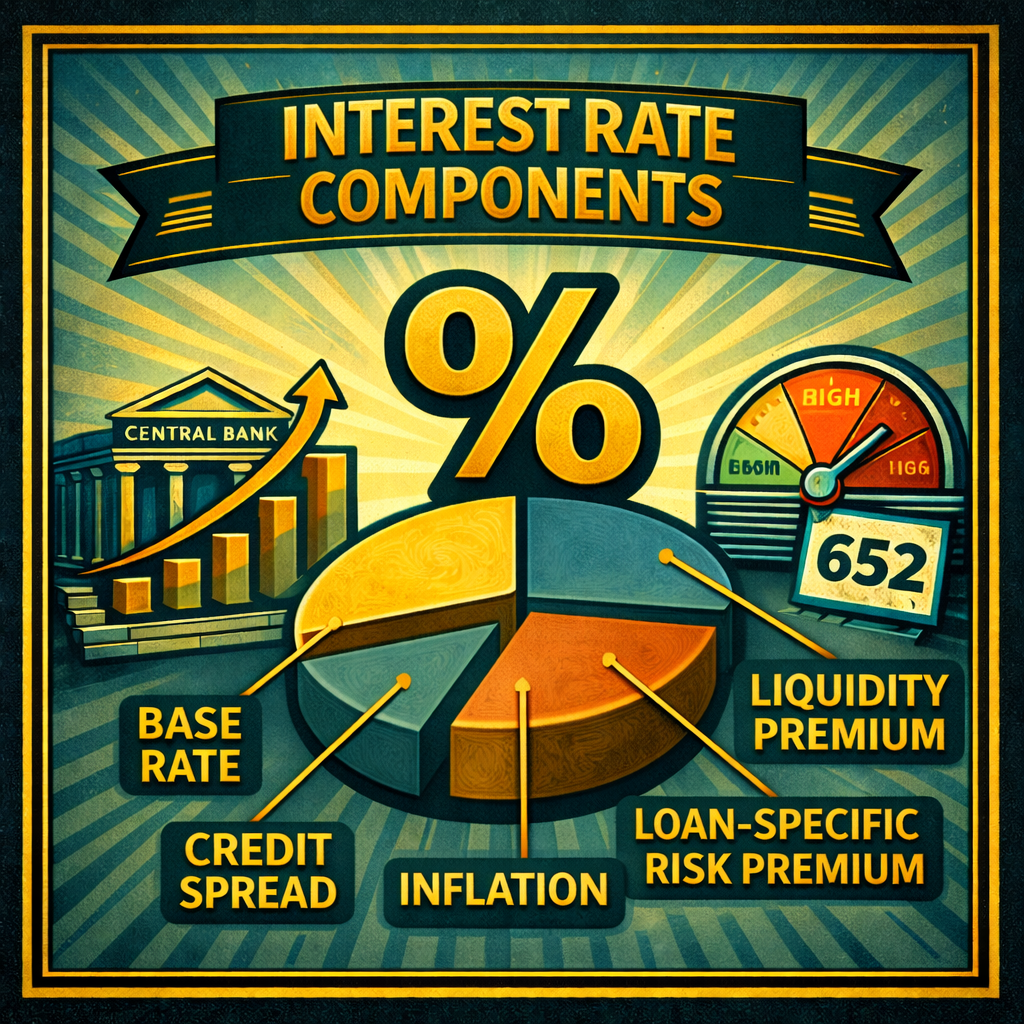

When a business gets a commercial loan, the interest rate isn’t just pulled from a hat — it’s built from multiple layers that reflect market conditions, borrower risk, and deal structure. Understanding how these components work gives you better leverage in negotiations and a clearer picture of what your rate actually means.

The Basic Formula

Final Rate = Benchmark Index + Spread Componenets

This is the foundation for most commercial loans — especially floating rate structures, but even fixed-rate loans are priced with the same elements in mind.

Breakdown of Rate Components

Component | What It Is | Example |

Benchmark Index | The market-based foundation rate used to price the loan. Common indexes include SOFR, Prime, or Treasury yields. (see: Benchmark Interest Rates) | SOFR = 5.3% |

Credit Spread | A margin added by the lender based on the borrower’s risk profile, financials, and industry. | +2.75% |

Loan-Specific Risk Premium | Additional spread based on the loan’s structure — such as short amortization, weak collateral, or high LTV. | +0.50% |

Liquidity Premium | Reflects how easy or hard it is for the lender to sell or offload the loan (relevant in syndications or niche markets). | +0.25% |

Total Rate | The all-in rate paid by the borrower. | 8.8% total |

🔍 What Drives the Spread?

Lenders assess several factors when determining how much spread to charge over the benchmark:

Borrower-Specific Factors:

Credit history & financial performance

Debt service coverage ratio (DSCR)

Leverage ratios

Industry risk

Deal-Specific Factors:

Loan size and structure

Term length and amortization

Collateral quality and type

Recourse vs. non-recourse

Guarantees provided

Market-Specific Factors:

Supply/demand for credit

Regulatory capital requirements

Inflation expectations

Interest rate environment

📈 Fixed vs. Floating Structures

Loan Type | How It’s Priced |

Floating Rate | Benchmark (SOFR/Prime) + Spread — adjusts over time |

Fixed Rate | Based on forward curve of Treasuries + internal credit pricing |

Hybrid/Swap-Based | Fixed rate is “swapped” from a floating base — still spread-based |

Understanding the components behind your rate helps you:

Negotiate smarter: Know what’s flexible and what’s market-driven

Compare lenders: One bank may offer the same benchmark but a tighter spread

Understand risk: A high spread = high perceived risk = room to improve

Plan for resets: If you’re floating, know how changes in SOFR or Prime affect you

Example: Two Borrowers, Same Benchmark — Different Rates

Borrower A (Strong Financials) | SOFR (5.3%) + 2.00% → 7.3% Rate |

Borrower B (Weaker Cash Flow) | SOFR (5.3%) + 4.00% → 9.3% Rate |

Same index — different pricing based on credit risk and structure.

Final Thoughts

A commercial loan’s interest rate is more than a single number — it’s a signal.

It reflects what the market thinks, what the lender expects, and what your business looks like on paper.

By breaking down the components, you gain clarity, credibility, and control.

Because in commercial lending, the spread tells a story — make sure you understand yours.