Curtailment

“Snip That Principal, Keep the Iron.”

What Is a Curtailment?

In commercial flooring lines of credit, a curtailment is a scheduled or triggered partial principal repayment that a borrower (e.g., a dealership) must make on a financed inventory item before it is sold.

Think of it as a gradual reduction in the outstanding loan balance for each item in inventory.

Why Do Curtailments Exist?

Lenders use curtailments to:

Reduce risk as inventory ages

Encourage dealers to move inventory faster

Avoid having the entire loan repaid only when an item sells (which can take months)

How Curtailments Work:

Initial Draw:

Let’s say a dealer draws $25,000 on the floor plan line to finance a car.

The car sits unsold on the lot.

Curtailment Schedule:

The lender may require:10% repayment after 30 days

Another 10% after 60 days

And so on…

Example:

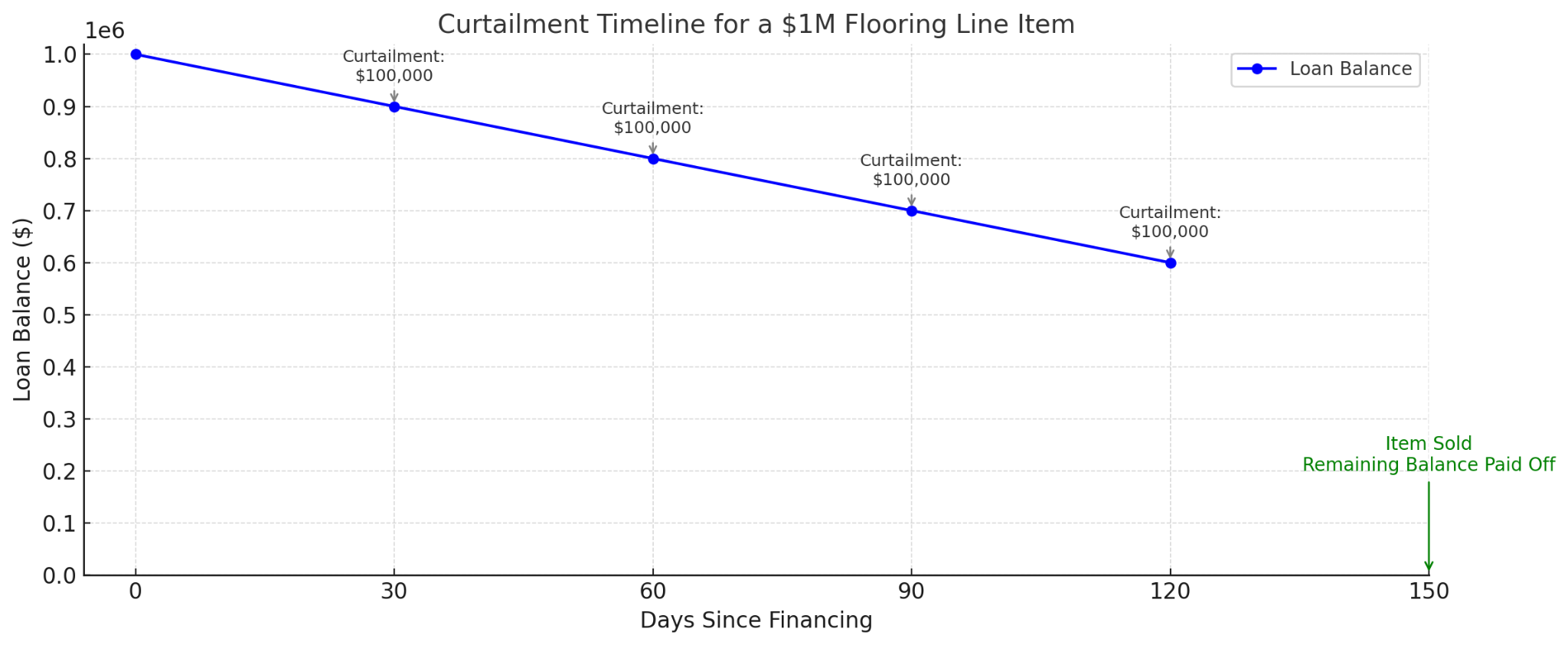

Day 0: Loan balance = $25,000

Day 30: Dealer pays $2,500 (curtailment), new balance = $22,500

Day 60: Another $2,500 → balance = $20,000

Sale of Item:

When the vehicle sells, the remaining $20,000 is paid off using sale proceeds.

The line of credit is replenished for future use.

At right is a visual timeline showing how curtailments reduce the loan balance over time for a $1Million flooring line item sold between

Day 120 and Day 150.

Related Topic

See: FLOORING LINES… specialized lines of credit used by businesses, particularlyautomobile dealerships

and equipment dealers, to purchase high-cost inventory items that are intended for resale.