Debt Service Coverage Ratio

(DSCR)

“More Flow than what you Owe”

The Debt Service Coverage Ratio (DSCR) is a key measure lenders use to evaluate whether your business generates enough income to comfortably cover debt payments. In plain terms, it answers:

“Do you have enough cash flow to pay your loans…and then some (a.k.a. “cushion”)?”

The DSCR Formula

DSCR = Net Operating Income (NOI) ÷ Total Debt Service

- NOI → Cash flow generated from operations (often EBITDA).

- Total Debt Service → All required principal and interest payments due within a year.

Practical Example

Your company’s NOI = $1,200,000 Your annual debt service = $1,000,000 DSCR = $1,200,000 ÷ 1,000,000 = 1.20 DSCR

This means you generate 20% more cash than required for debt service (meeting a common lender benchmark).

How to Read DSCR

DSCR < 1.0 → Shortfall

You don’t earn enough to pay debt — a warning sign of financial stress.DSCR = 1.0 → Break-Even

You earn just enough to cover debt — but with no cushion for surprises.DSCR 1.01 – 1.24 → Thin Cushion

You’re covering debt with a small margin, but even modest downturns or cost increases could put you below 1.0.DSCR ≥ 1.25 → Healthy Cushion

Strong coverage. You consistently generate surplus cash above debt requirements — the level most lenders consider safe and bankable.

Even simpler:

≥1.25 = comfort zone

1.0–1.24 = watch zone

<1.0 = danger zone

Why It’s a Big Deal

For Business Owners: A strong DSCR signals financial health and strengthens your position when negotiating loan terms.

For Lenders: It provides confidence that you can repay without financial strain.

For Decision Makers: It’s a critical benchmark when planning expansions, acquisitions, or refinancing.

Typical Lender Expectations

Commercial banks often require 1.20× DSCR or higher.

Riskier industries or larger loans may demand an even higher ratio.

Falling below the required DSCR can trigger loan covenants or limit access to additional credit.

🏢 Example: Commercial Real Estate – Office Building Loan

Scenario:

A developer owns a mid-sized office building with long-term tenant leases.

Annual rental income (gross): $2,000,000

Operating expenses (utilities, management, taxes, maintenance): $700,000

Net Operating Income (NOI): $1,300,000

Annual debt service (principal + interest): $1,000,000

DSCR Calculation:

DSCR = $1,300,000 ÷ $1,000,000 = 1.30DSCR

Interpretation:

The property generates 30% more cash flow than is needed to pay debt service.

Lenders would consider this a healthy margin — comfortably above the typical 1.20× covenant.

If interest rates rose and debt service increased to $1,150,000, DSCR would fall to 1.13× — still positive, but potentially too thin for refinancing without sponsor support.

Takeaway:

Strong profitability and stable leases protect the borrower, but rising rates can quickly erode cushion.

🏭 Example 2: Manufacturing Business Expansion Loan

Scenario:

A regional manufacturer borrows to purchase new equipment to expand capacity.

Annual revenue (post-expansion): $10,000,000

Operating expenses (materials, labor, overhead): $8,200,000

EBITDA / NOI: $1,800,000

Annual debt service (loan for new equip.): $1,500,000

DSCR Calculation:

DSCR = $1,800,000 ÷ $1,500,000 = 1.20DSCR

Interpretation:

Exactly at the minimum lender threshold of 1.20×.

Any dip in sales, margin squeeze on materials, or unexpected downtime could reduce NOI and push DSCR below covenant requirements.

The lender may require:

Additional collateral,

A personal guarantee from the owner, or

A reserve account to cover unexpected shortfalls.

Takeaway:

The expansion is just viable, but thin margins make the loan riskier. Improving profitability (e.g., raising prices or optimizing costs) would strengthen DSCR and give more negotiating power.

How Profitability Influences DSCR

Profitability is at the core of DSCR because higher profits (especially operating profit, not just net profit after taxes) directly improve the numerator in the ratio.

Higher margins = stronger DSCR:

If your revenue grows but your costs grow faster, your NOI (and thus DSCR) doesn’t improve. True DSCR strength comes from profitability, not just sales volume.Sustainable profits vs. one-time gains:

Lenders will often adjust NOI to strip out unusual or nonrecurring income (like asset sales, government relief funds, or one-off contracts) to see if your profitability is truly sustainable.EBITDA vs. Net Profit:

DSCR is typically based on EBITDA (or NOI in real estate), which focuses on operating profitability. Even if your bottom line net profit is low after taxes or depreciation, a strong EBITDA can keep DSCR healthy.Profitability buffers against shocks:

When profits are strong, you can weather downturns, rate hikes, or expansion costs without DSCR falling below covenant thresholds.

Other DSCR influencers*:

- Revenue swings: Seasonal sales, downturns, or sudden growth.

- Operating costs: Rising expenses reduce NOI.

- Debt structure: Loan size, interest rates, and amortization schedules.

- Business strategy: Expansion or refinancing can affect ratios in the short term.

(*all really factors that feed into or erode profitability — and profitability is what ultimately drives DSCR strength.)

Common loan covenant types involving DSCR

DSCR isn’t just a calculation, it’s often hard-wired into loan agreements as a covenant. Lenders use it as a guardrail to make sure a borrower maintains enough cash flow to service debt.

Minimum DSCR Covenant (the classic one)

- Definition: Borrower must maintain DSCR above a specified threshold (often 1.20×).

- Example: “Borrower shall not permit DSCR to fall below 1.20×, tested quarterly on a trailing-12-month basis.”

- Purpose: Protects lender from excessive leverage or declining profitability.

Debt Incurrence Covenant

- Definition: New borrowing or acquisitions are only allowed if projected DSCR stays above the threshold.

- Example: “No additional indebtedness unless pro forma DSCR is at least 1.25×.”

- Purpose: Prevents the borrower from taking on new debt that would strain coverage.

Restricted Payments Covenant

- Definition: Dividends, equity withdrawals, or bonuses are restricted unless DSCR exceeds a higher threshold.

- Example: “No distributions to owners unless DSCR is greater than 1.30×.”

- Purpose: Keeps cash in the business to protect debt service.

Financial Reporting Covenant

- Definition: Borrower must calculate and report DSCR regularly (monthly, quarterly, or annually).

- Example: “Borrower shall deliver a DSCR certificate within 45 days of each quarter-end.”

- Purpose: Ensures transparency and early detection of coverage problems.

Default / Remedy Triggers

- Definition: Falling below the covenant threshold can constitute a technical default. Remedies may include:

- Raising equity,

- Providing additional collateral,

- Loan repricing (higher rates),

- Or accelerated repayment demands.

✅ Bottom Line:

DSCR covenants are some of the most common financial covenants in commercial loans, real estate finance, and corporate credit agreements. They protect lenders — but for business owners, they also act as a built-in early warning system to monitor debt sustainability.

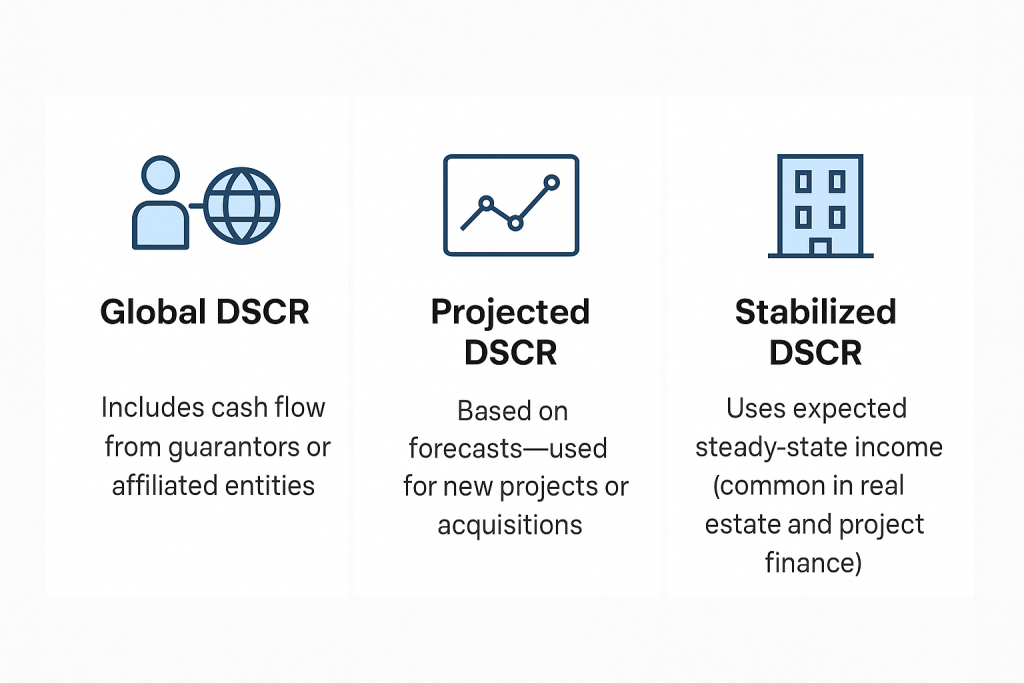

📊 Types of DSCR

Together, these DSCR variations let lenders

(and owners) view DSCR through different lenses:

• today’s reality

• tomorrow’s forecast

• and long-term sustainability.

• Global DSCR

Looks beyond just the borrowing entity and includes cash flow from owners, guarantors, or affiliated companies.

Example: A subsidiary might look weak on its own, but when parent company cash flow is added in, the DSCR improves. Common in closely held businesses and sponsor-backed deals.

• Projected DSCR

Calculated using forward-looking financial forecasts instead of historical results.

Example: A business buying new equipment may not have the current NOI to support the loan, but based on projected revenue growth, the DSCR shows future ability to cover debt. Lenders often require conservative assumptions here.

• Stabilized DSCR

Assumes an asset or project has reached its normal, steady-state operations, ignoring temporary start-up or lease-up phases.

Example: A new apartment building under construction may not hit full occupancy for two years, but the stabilized DSCR measures coverage once it’s fully leased. Widely used in commercial real estate and infrastructure finance.

Key DSCR Takeaways for Business Leaders

- DSCR is not just for lenders—it’s a management tool for assessing whether your debt load is sustainable.

- A higher DSCR gives you negotiating power with banks and investors.

- Monitoring DSCR over time helps you plan growth, expansion, and risk management more effectively.

✅ Bottom line:

Think of DSCR as your business’s financial “safety margin” for debt. The stronger it is, the more confidence you inspire in lenders, partners, and investors.

💡 Bonus Example: Trucking Company with Cash Flow Shortfall

Scenario:

A regional trucking company has a fleet loan and is facing rising fuel costs.

- Annual revenue: $5,000,000

- Operating expenses (fuel, wages, insurance, maintenance): $4,200,000

- EBITDA / NOI: $800,000

- Annual debt service (fleet loan + term loan): $1,000,000

DSCR Calculation:

DSCR = $800,000 ÷ $1,000,000 = 0.80 DSCR

Interpretation:

- For every $1 of debt service, the company generates only $0.80 of cash flow.

- This means they are short $200,000 each year just to cover scheduled debt payments.

- Lenders view this as a red flag because the business cannot fully cover its obligations from operating income.

Possible Outcomes:

- The company may need to draw on reserves, owner capital, or lines of credit just to make payments.

- A DSCR < 1 often leads to:

- Loan covenant violations,

- Restructuring talks with the lender, or

- Requirements for additional collateral or equity injections.

Takeaway:

A DSCR below 1.0 signals unsustainable debt unless profitability improves quickly. For this trucking company, controlling fuel costs, increasing freight rates, or refinancing to lower payments are urgent priorities.