Owner’s Equity & Net Worth

“Assets flex, Liabilities check — Equity’s what’s left.”

Owner’s Equity (for private businesses) or Shareholders’ Equity (for corporations) represents the residual value of the business after liabilities are subtracted from assets.

In plain terms, it’s the owner’s “stake” in the business — what’s left over if all debts were paid and all assets sold.

It’s what is truly owned, not just what is controlled.

Net Worth is a broader but similar concept often used for both businesses and individuals,

but conceptually, it’s the same calculation: Net Worth = Assets – Liabilities

For Individuals … it reflects personal assets minus personal liabilities.

For Businesses … it reflects the same equation applied to the company’s balance sheet.

Practical Example

A company balance sheet shows:

- Total Assets: $1,000,000

- Total Liabilities: $700,000

- Owner’s Equity/Net Worth: $300,000

This means the owner’s stake in the business is $300,000.

Common Misconceptions

“High revenue means high net worth.”

Not necessarily. Net worth depends on assets versus liabilities, not just sales.

“Equity is the same as cash in the bank.”

No — equity represents residual value or “paper value”, which may be tied up in assets and not readily liquid. It doesn’t always reflect liquid funds.

“Negative equity always means failure.”

Not always. Startups often carry negative equity in their early stages due to heavy upfront investment.

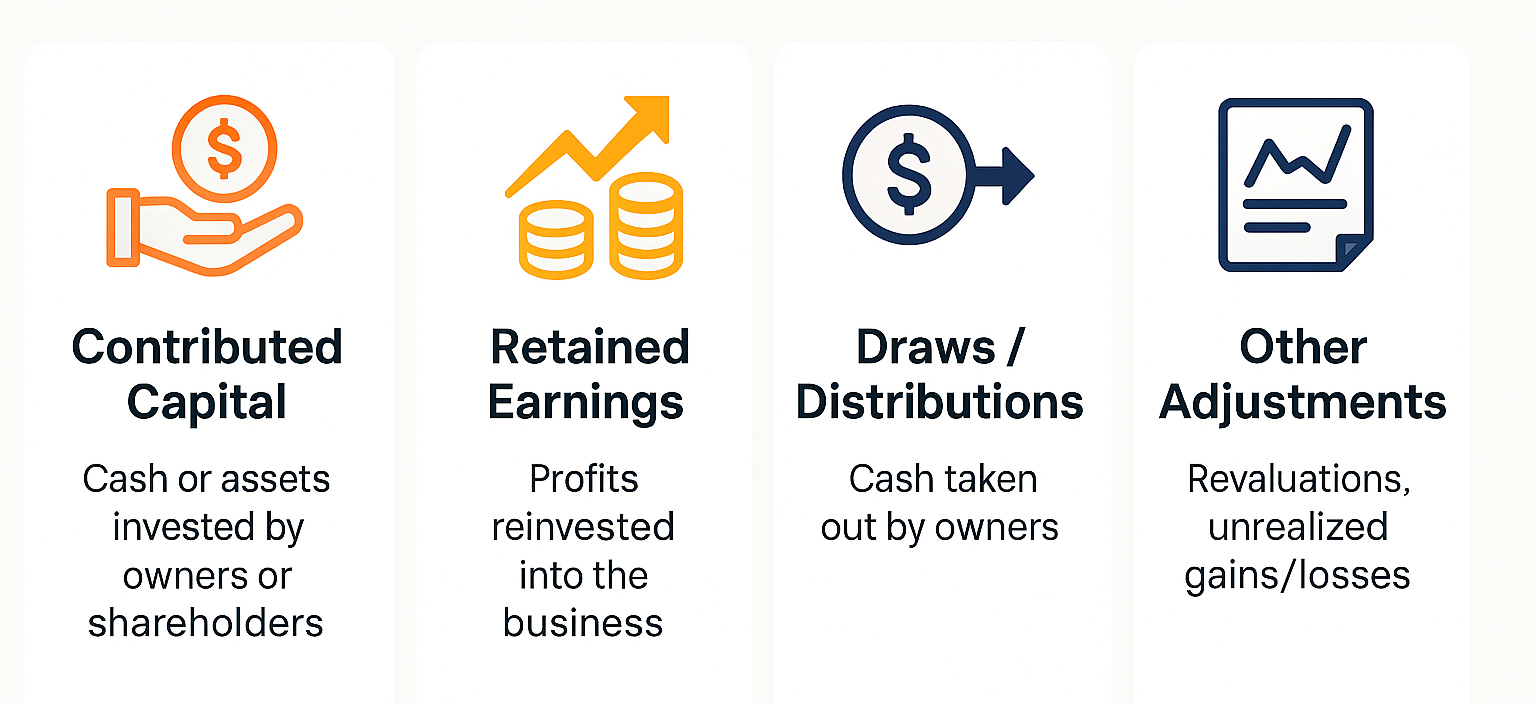

🔑 Key Components of Owner’s Equity

Contributed Capital

- Also called “paid-in capital,” this represents the cash or assets that owners or shareholders originally invest in the business.

- It’s the starting foundation of equity and reflects the owner’s skin in the game.

Example: If you put in $50,000 to launch your company, that amount shows up here.

Retained Earnings

- These are profits the business has generated and kept over time, rather than distributing them as dividends or owner draws.

- Retained earnings build equity year after year when the business is profitable.

Example: A company earns $100,000 in profit and reinvests it instead of paying it out — equity grows by that same amount.

Draws / Distributions

- Cash or assets taken out of the business by owners. These reduce equity.

- In large corporations, this typically takes the form of dividends; in sole proprietorships or partnerships, it’s called an owner’s draw. LLC’s and Subchapter S Corporations typically receive distributions of earnings.

Example: If you pull $20,000 out of the business for personal use, your equity decreases accordingly.

Other Adjustments & Comprehensive Income

- Not all changes come from profits or contributions. Accounting rules sometimes adjust equity for things like:

- Foreign currency translation (for global businesses),

- Unrealized gains or losses on investments,

- Revaluation of certain assets (like real estate).

These adjustments can swing equity up or down even without a cash transaction.

⦿ How Profit and Loss Affect Equity

Profits increase equity

When a business earns net income, those profits flow into retained earnings, which are part of equity. If they aren’t paid out as dividends or draws, they stay in the company and grow the owner’s stake.

✦ Example: $100,000 profit → Equity increases by $100,000.

Losses decrease equity

When a business records a net loss, it reduces retained earnings, shrinking equity. Repeated losses can even push equity negative.

✦ Example: $50,000 loss → Equity decreases by $50,000.

Dividends / Draws / Distributions

Even if profits are earned, distributing profits to owners removes them from equity.

This is why a profitable business might not see equity growth if all profits are pulled out.

Business Impact of Owner’s Equity & Net Worth

Financial Health Check

Equity is like a long-term report card for your business. A growing equity position shows that profits are being retained and value is compounding. Declining or negative equity signals erosion of value, which can limit flexibility and reduce resilience.

Lender Confidence

Banks and investors look at equity as a buffer. Strong equity reassures them that even if sales dip or costs rise, the business has enough built-up value to handle debt obligations. This often translates into better loan terms, lower rates, or higher borrowing capacity.

Growth Planning

Equity helps determine whether a business can self-fund expansion (through retained earnings and reinvested profits) or whether it needs outside capital. A robust equity base gives owners more options and stronger negotiating leverage when seeking funding.

Risk Management

Negative equity is a warning sign, but context matters. It could indicate severe financial strain, or it could simply reflect a young business in a heavy investment stage (like a startup spending upfront on equipment or R&D before revenue catches up). Monitoring the trend over time helps distinguish between short-term investment phases and long-term distress.